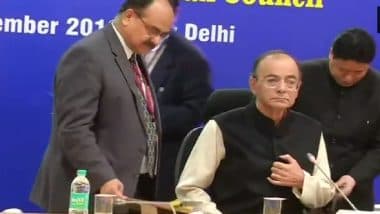

New Delhi, December 22:슬롯 머신 사이트 추천Goods and Services Tax on 33 items have been슬롯 머신 사이트 추천slashed today. The decision was taken during the 31st GST review meeting at Vigyan Bhawan in New Delhi. Finance Minister Arun Jaitley headed the meeting. The new rates will come into effect from January 1. Out of 33 items, seven are from the 28 percent slab. Meanwhile, a group of seven ministers will be constituted to look into revenue loss to states슬롯 머신 사이트 추천and structural problems of GST.

The Items which are brought under 18 percent to 28 percent slab are Monitors and screen up to 32 inches, gearboxes, retreaded tyres, power banks of lithium-ion batteries, video games and other sports-related items.슬롯 머신 사이트 추천 The council also decided to compensate states with Rs슬롯 머신 사이트 추천60,000 crore. Meanwhile, tax on cinema tickets of up to Rs 100 has been brought down to 12 percent. However, for tickets above Rs 100, GST has been reduced to 18 percent.슬롯 머신 사이트 추천Congress Jolted Narendra Modi From His Deep Slumber, Says Rahul Gandhi on PM's GST Relief.

Services supplied by banks to a basic savings bank account and Jan Dhan accounts will be exempt from GST. Now, there are only 28 items left in the 28 percent bracket including luxury and sin items. Meanwhile, GST rate on cement and auto parts has not been changed.슬롯 머신 사이트 추천During슬롯 머신 사이트 추천media briefing after the meeting, Jaitley said, "Here are 28 items left in the 28% bracket if we include luxury and sin items. 13 items are from automobile parts and one is cement."

He further added, "Cement슬롯사이트™s revenue is 13000 crore and automobile parts revenue is 20000 crore. If they are brought down from 28 percent to 18 percent implications are of 33000 crore." The government will also start슬롯 머신 사이트 추천New return filing system on trial from April 1. It will mandatory will be implemented from July 1, 2019. Meanwhile, issues on taxation on residential properties will be discussed in the next meeting which is scheduled to be held in January.슬롯 머신 사이트 추천Today's GST rate reduction will have an overall impact on revenue of Rs 5500 crore, said the finance minister.

The decision to lower the tax rate came days after Prime Minister Narendra Modi vowed to lower GST on 99 percent items and to include them in 18 per cent or less tax slab. The GST has five tax slabs of 0, 5, 12, 18 and 28 per cent with daily essential items attracting 'nil' tax rates and some white goods, apart from luxury and sin items, placed at the highest tax rate.

(The above story first appeared on LatestLY on Dec 22, 2018 04:02 PM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly